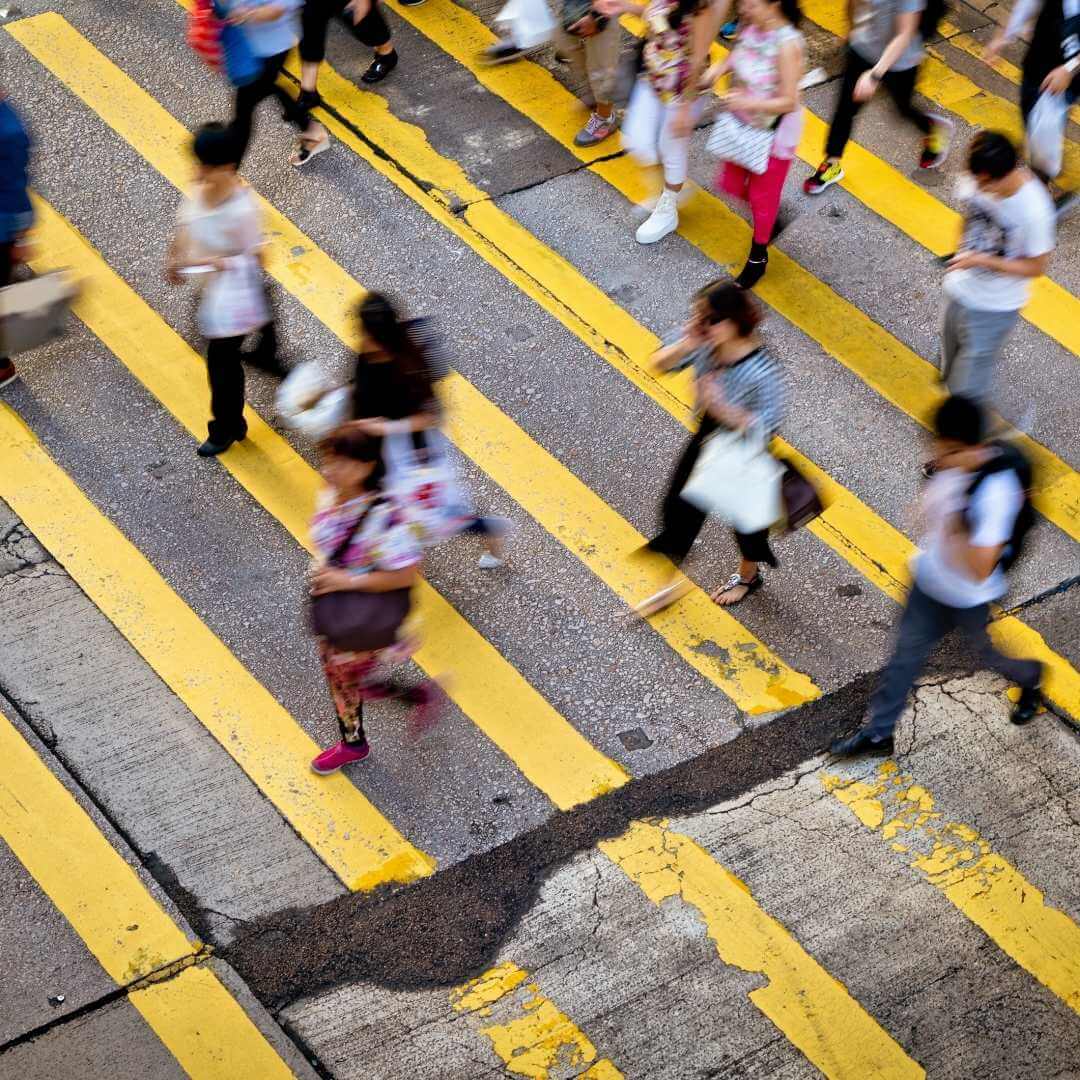

The majority of significant consumer-facing businesses recognise that in the coming decade, China will be critical to their success. However, in order to keep up, these businesses will need to comprehend the economic, cultural, and demographic shifts that are influencing consumer profiles and spending habits. This is no simple feat, because of China’s rapid expansion and resulting changes in its way of life. The country’s massive economic and demographic disparities add to this challenge.

The most fundamental trend influencing the Digital Landscape in China has been and will continue to be ‘changes in economic profiles & their characteristics’. Surveys and studies have tracked the growth of incomes, shifting spending patterns and the development of many different consumer segments. Let’s take a quick look at these various segments.

The 80’s Segment

Chinese born in the 1980’s, known as 80 Hou, are famous to Westerners as the first generation born during the enforcement of China’s one-child policy. The 80 Hou is a generation of more than 200 million only children with common burdens and opportunities. Their thinking is formed by traditional Chinese culture and Confucian morals, but they began their careers in a nearly full-blown market guided by the rules of the WTO. Many of them are single-handedly responsible for providing financial assistance for their retired parents. As the 80 Hou’s fulfil their responsibilities and accomplish their social goals, their unique perspective is sure to influence trends in the global economy.

The 90’s Segment

Chinese Millennials born after the 1990’s, have a direct influence on 50% of their family’s purchase decisions. This is because of the information they consume via the internet and despite their dependence on their parents for money. Some of those purchase decisions include houses, cars, and home appliances. 60% of the urban post-90’s youngsters have their own credit cards.

Millennials – A Closer Look

400 million out of the total 1.4 billion people in China consist of millennials. Brands all over the world target the millennial population in most countries by ringing in elements through their brand communications that are familiar with the national cohort. Chinese millennials born between 1981 and 1996 make up 25% of China’s population with the highest purchasing power. Their spending is projected to increase by 11% in 2021. 90% of the Chinese millennials possess a smartphone along with a large appetite for luxury goods. Millennials were key contributors to the travel boom in 2017 that amounted to a total of $115 billion spent by Chinese visitors. The group born after 1990 upscaled their budget by 80% in 2018 for international travel.

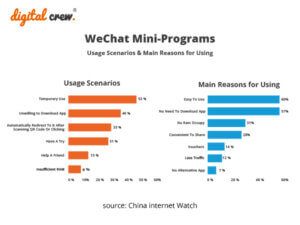

The education sector saw one in three Chinese students that were paying full fee amounts. This generation is the first to have grown up in a time where social media apps like WeChat, Weibo, Xiaohongshu and social shopping are highly integrated into their lives. They are concerned about their social image which drives brands to move towards targeting their curated lifestyles. The impact of social media-related self-image creation, is set to increase exponentially over the next decade as millennials and Gen Zers are all set to influence generations of consumers.

The young Chinese adults have coined terms for the exclusive lifestyles they have devised for themselves. Chinese millennials are now saving up to live their life by investing in experiences like travelling, concerts, sporting events etc.

In Summary

China is undergoing a consumption revolution. The Chinese consumers’ purchasing behaviour has gotten more sophisticated, and they are considering more criteria when purchasing a product or a service. Brand awareness is growing in importance, and digital marketing & monitoring is beginning to play an increasingly essential role in acquiring these Chinese consumers. Get in touch with an expert to discuss the best approach for your business today.