Despite the protracted COVID-19 pandemic and an increasingly complex global environment, foreign businesses are voting in favour of the Chinese economy. They are seeing possibilities among the country’s opening-up efforts.

The Chinese economy, with its 1.4 billion customer base, is the market to watch right now.

The trends and decisions made by these consumers on what, when, how, where, and why to buy will have a particularly large impact on countries whose economies rely on how much the Chinese buy from them. It’s only natural when you’re the world’s second-largest importer!

Here are a few trends that are shaping the growing Chinese economy in 2022.

China’s Consumer Market Steams Ahead

According to official figures:

-Retail sales of consumer goods in China, the world’s second-largest economy, increased 12.5% year on year to 44.1 trillion yuan ($6.95 trillion) in 2021

-China’s real GDP is expected to increase at a 7% yearly rate between 2021 and 2023

Foreign companies are seeing greater business opportunities as China continues to open its doors wider. Foreign businesses are benefiting as the Chinese government continues to encourage high-level opening-up and innovation-driven development while strengthening the business environment.

China’s consumer market is predicted to grow faster in 2022, owing to the country’s great consumption potential and further supportive policies in the works. Last year, final consumer expenditure accounted for 65.4 % of the country’s economic growth. This demonstrates that consumption was the primary driver propelling the economy ahead.

China’s legislature is now amending the country’s science and technology progress law to allow for increased government spending on next-generation technologies.

China – The Engine For Global Growth

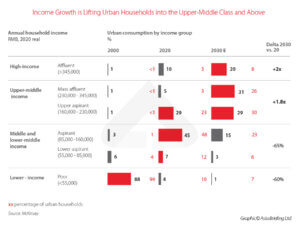

The rise of China’s middle class is well documented. In 2000, over 1.2 billion Chinese citizens had less than US$11 to spend per day. According to data analysis by McKinsey & Company, it is projected that roughly the same number of people would join the consuming class and move up the income pyramid within it by 2030.

Note: People become members of the consuming class when they are able to afford some discretionary goods and services on top of basic necessities.

Consumers in the upper-middle classes are expected to drive the majority of growth in China during the coming decade. Upper-middle-income consumers (with annual household incomes ranging from RMB 160,000/US$25,200 to RMB 345,000/US$54,400) are expected to drive 60% of urban spending by 2030 (up from 35% now).

Another 20% of spending could come from the sector above them, as “high-income consumers” (annual household incomes of RMB 345,000/US$54,400 or more) will more than quadruple their current 10% share.

Furthermore, as we have seen over the last decade, China is becoming the market for products & services aimed towards higher-income consumers. And by 2030, China could boast 400 million upper-middle and higher-income households – almost the same as Europe and the United States combined.

Prominent Spending Patterns & Markets

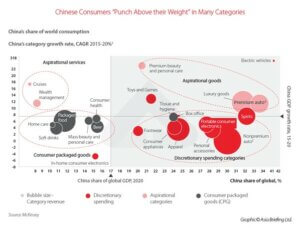

As of 2022, China accounts for approximately 17% of global GDP. The country accounts for a larger amount of consumption in a variety of sectors.

In terms of its share of national GDP, China has a strong consumption pattern in categories such as fashion, accessories, consumer electronics, and electric vehicles (EV). Many of these categories are developing far faster in China than the rest of the globe, indicating that China remains an essential engine of global growth.

a) Medium & High income Market

Products aimed at people with a medium to high income and a luxurious lifestyle, such as luxury goods, premium beauty and personal care products, and high-end cars, are popular in China. Surprisingly, additional value-added or high-end services, such as wealth management and cruise services, have yet to be desired by this segment of Chinese customers – China buys less than the global average.

This indicates that there is a prospective market growth opportunity that should be pursued. In recent years, some of that promise has begun to be realized in the area of wealth management and financial services. This category has been increasing at a rate of nine percent per year in China, three times faster than the global average. Financial services have been identified as one of the priority industries for the country’s development, by the Chinese central and local governments.

b) EVs

China accounts for 40% of worldwide EV spending, and investment in these products is growing at a rate that is more than 7 times faster than the global average. It is the clear market leader in the procurement of EVs.

c) Consumer Packaged Goods

Even when a larger proportion of China’s population enters higher-income brackets, consumption in several categories of “mass” consumer packaged goods (CPG) remains underweighted relative to China’s share of global GDP. China’s GDP accounts for between 10% and 15% of overall consumption of packaged food, home care products, mass beauty, personal care, and other health items.

A Global Vote Of Confidence

China’s allure for international businesses in a pandemic-stricken world stems from the country’s steady economic recovery and improved business environment.

According to a Report produced by the American Chamber of Commerce in China and PwC, almost 60% of surveyed companies reported profits in China in 2021. This year, two-thirds of companies intend to boost their investment in the country. According to the survey, over two-thirds of AmCham China’s member companies ranked China as the world’s top or among the top three investment locations.

According to another research produced by the German Chamber of Commerce in China and KPMG, nearly 60% of German companies in China reported improved business operations last year, and 71% want to spend more in the country.

New Year – New Rules

China allows for a lot of grey areas when it comes to regulations. These regulatory grey areas can actually benefit smaller businesses. There are still several developing industries in China where foreign businesses can find a place, such as in specialized fintech.

Furthermore, because major internet businesses are now being compelled to play fairly. This creates opportunities for startups to enter and expand into areas that these tech titans previously dominated.

In Summary

With 8.1% GDP growth in 2021, the Chinese economy provided a strong boost to the global economy. China has set its economic growth target for this year at roughly 5.5%, which is likely to support the global economic recovery.

China’s persistent and stable economic growth will create more chances, and we are confident about the Chinese market’s development prospects. The key, however, is to find the right partner. This is where a Chinese digital marketing agency like Digital Crew comes in.

Of course, not everything is rainbows and sunshine. Doing business in China has never been easy, and it is likely to become in certain aspects. The most difficult obstacles will be data protection and areas deemed critical to national security.

New restrictions will force businesses to ensure that they have the proper data architecture in place so that data may be kept and backed up in China. This will necessitate extra investment.

Businesses must have their “eyes wide open.” Get in touch with us to start building your Chinese marketing strategy, which can turn into a lucrative endeavour for your business.