The 14th edition of China’s Double 11 online shopping festival concluded last month and this year it brought many changes that reflect significant new trends in the Chinese market. Double Eleven results are always viewed as a guiding compass for brands as they navigate the year ahead, so how did things turn out during Double Eleven 2022?

China’s Most Diverse Event Thus Far

China’s digital economy not only supports the growth of the real economy, but also creates many new types of businesses, providing a new source of growth for the Chinese economy.

This year’s Double 11 shopping festival attracted over 290,000 brands, and millions of small and medium-sized businesses, including live-streaming sellers. During the event, more than 21 million products were on display. Many brands reported record sales as China’s Double 11 online shopping festival concluded with new trends and highlights amid the country’s continued recovery in consumption.

Sales Hitting New Heights

Although consumer expectations and business sentiment remain cautious during the epidemic, companies’ sales growth during the Double 11 festival demonstrates that China’s consumption is now recovering.

Tmall revealed that the turnover of 102 brands exceeded $13.8 million in the first hour of the festival on October 31. Douyin’s GMV increased 629.9% (year on year) on the first day of this year’s Double 11 event.

In terms of new retail platforms, the GMV reached 21.8 billion yuan during “double 11,” with Meituanshangou, JDtohome, and Tao Xian Da claiming the top three positions in terms of sales. With total sales of 13.5 billion yuan, community group buying platforms did not perform well, compared to previous years. The top three community group buying platforms at the festival were Duo Duo Mai Cai, Mei Tuan You Xuan and Xing Sheng You Xuan.

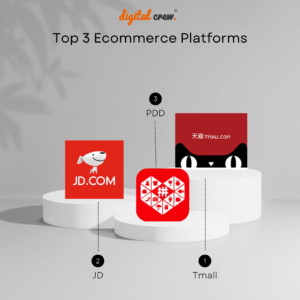

The GMV of the major e-commerce platforms (only traditional e-commerce platforms and live streaming e-commerce platforms) was 1115.4 billion RMB during 2022 China’s “Double 11” festival.

The GMV of traditional e-commerce platforms was 934 billion RMB, with Tmall platform ranking first. JD.com and Pinduoduo claimed the second and third spot respectively.

Categories & Trends – New Areas & Spending

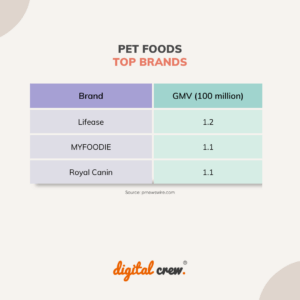

New consumption trends can be identified this year. Tmall reported that the new four pillar industries are outdoor sports, pet supplies, collectible toys, and jewelry. 358 brands’ sales in those four categories exceeded 100 million RMB. Traditionally, the four power pillar industries were beauty, FMCG, consumer electronics, and clothing.

The sales of running outfits increased by 45.2% in the first hour after the festival began this year on October 31, compared to the same time last year. Camping and skiing products increased by 115% and 61.9%, respectively.

JD.com also identified eight new consumption trends, including increased spending on long-term investments, particularly in the health, wellness, and education categories, as well as on environmentally friendly labels.

Green and energy-saving home electric appliance sales have increased by 126%. Tmall also revealed that sales of new-energy vehicles increased by 200 percent in the first 30 minutes of the online festival. During the festival, over 16 million people purchased green products on Tmall. According to Alibaba, popular products included energy-saving air conditioners and washing machines.

Other major JD.com trends included a focus on new releases and items that provide comfort, for example rocking chairs and scented candles.

What About Luxury Products?

This year, Tmall welcomed over 200 luxury brands. The products were featured in the categories of handbags, fashion, jewelry, beauty, and alcohol.

Instead of offering discounts this year, many international brands used the festival to launch new products. Tmall launched over 100,000 new luxury products on Double 11 this year. Meanwhile, JD.com used new technologies such as the metaverse, virtual reality, artificial intelligence, and digital collectibles in omnichannel scenarios to boost Double 11 luxury shopping.

Top-performing luxury houses such as Bulgari, Celine, Fendi, and Loewe saw their revenue nearly double in the first 10 minutes of peak shopping compared to last year. Others, including Burberry, Ferragamo, Prada, Lanvin, and Qeelin, reportedly increased their revenue by more than 227 %, promising peak season sales. JD.com’s turnover of luxury handbags and shoes increased 180% year on year, indicating yet another boost for luxury.

Live streaming & Social commerce Continue to Rise

At the Double shopping festival, new online business models such as live streaming sales drew a lot of attention. Year on year, the average daily view of live streaming selling events on Taobao increased by 561%.

Despite the return of top live streamers such as Li Jiaqi to Diantao, Tiktok’s sales were slightly higher than Diantao’s.

In China, Double 11 2022 demonstrated the significance and effectiveness of social commerce, KOL & KOC marketing, live streaming, and meaningful, relatable brand stories. This year’s Double Eleven was dominated by social commerce. GMV on Douyin, Kuaishou, and Diantao increased by 146.1% year on year, accounting for 181 billion of total GMV for Double Eleven last year, according to Syntun. This compares to 73.76 billion in the same period in 2021. Douyin ranked the highest in terms of sales volume, reiterating the importance and power of social commerce.

As social commerce grows in popularity, the Chinese e-commerce landscape is becoming more decentralized, with platforms focusing on customer retention and loyalty. Similarly, brands are following this trend by developing omnichannel e-commerce and marketing strategies and tailoring brand content to the unique characteristics of various platforms in order to reach a larger group of consumers. E-commerce platforms reflect this focus by shifting the emphasis away from showing who sold the most. The winner is whoever keeps the most customers.

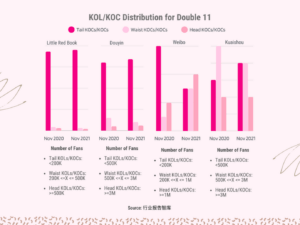

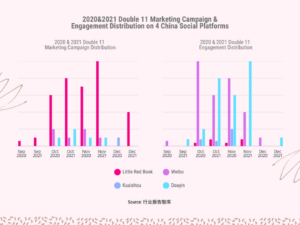

DOUBLE 11 KOL/KOC & CONTENT STRATEGY FOR 2023

This year, brands used Little Red Book to target tail KOLs/KOCs in order to increase impressions and awareness. On Douyin, brands have embraced greater distribution of tail KOLs/KOCs while decreasing investment in waist KOLs/KOCs. The primary sources of influence on Weibo are head KOLs/KOCs.

Two major assessment factors for KOL/KOC selection and distribution are exposure rate and conversion rate. Brands can collaborate with different KOLs/KOCs based on their sales effectiveness in terms of the frequency of Livestream sessions, GMV (gross merchandise volume) per live stream, product ROI, session duration, and the number of live stream participants.

New Consumption Habits & Opportunities For Foreign Businesses

The Chinese government has repeatedly announced measures to boost consumption, a sector that has been hit hard by the coronavirus outbreak. In the medium to long term, the penetration rate of China’s e-commerce sector has been very high, and consumption is becoming increasingly decentralized.

During the Double 11 festival, over 16 million people purchased green products on Tmall. Energy-saving air conditioners and washing machines were popular items. In recent years, China’s new-energy vehicle industry has also grown rapidly.

The Double 11 online festival continues to be a gold mine for international brands, with more and more brands participating in the country’s largest online gala, ranging from luxury to fast-moving consumer goods. This year, the Double 11 festival was attended by all five major global luxury conglomerates, including LVMH and Kering. According to JD.com data, Apple’s platform turnover surpassed 1 billion yuan ($140 million) just one minute after the Double 11 began this year.

China’s consumption sector which previously exited a period of reckless growth, is now transitioning to a new stage with new characteristics such as a focus on quality.

Quality and loyalty over quantity?

As markets mature in the face of economic uncertainty, the focus is now on how to improve the consumer experience. This year, Tmall increased the maximum number of products that can be saved to shopping carts from 120 to 300.

Developing membership systems has become a priority for both merchants and platforms in order to increase customer loyalty. Alibaba launched its “88 membership” loyalty program in 2017 to increase customer engagement and improve personalized service. Today, the initiative is still a success. Alibaba revealed in June that the 25 million users who have signed up for its loyalty program have spent an average of $4,865 (57,000 RMB) per person in the previous year.

Brands are also developing their own membership programs, with current VIP members accounting for a sizable portion of sales. During this year’s Double 11, over 2,700 Tmall businesses saw their own members drive half of their total sales. Furthermore, over 4,000 brands saw a 100% increase in member turnover compared to the previous year.

Shift in focus

The official tone touted by platform executives was very different from previous years, with the stance appearing to be more wholesome and focused on unity. These new attitudes and approaches can be viewed through the larger lens of social, economic, and political changes occurring throughout China. As part of its campaign to achieve “common prosperity,” the government is attempting to promote more responsible and sustainable consumption behavior. Platforms have echoed this sentiment in the manner they launch shopping events.

Once known as China’s most important online festival, during which people maxed out their credit cards and bizarre events such as a huge gala and a countdown ceremony were held. This year’s “Double 11” online shopping festival proved to be more restrained and rational, though certain sectors saw stunning growth.

Instead of focusing on sales figures this year, the platforms emphasized accomplishments in areas such as farmer assistance and green and environmental protection. Aside from commercial value, the platforms’ ability to create social value is constantly improving. All platforms and brands are focusing on how to retain users and provide a better shopping experience.

In Closing

The Double 11 shopping festival demonstrated the growing importance of China’s digital economy, despite the impact of the global economic downturn and the resurgence of COVID-19. Get in touch to figure out the best approach for your business in the Chinese market