Apple’s Tmall sales exceeded US$2 bn this year!

What Is 618 Shopping Festival?

The annual “618 Shopping Festival” is the most important consumer battleground in the first half of the year. It has become a critical market for all e-commerce platforms. The “618” pre-sale this year also began as early as May.

This year’s “618” included improved user shopping experiences with more simple promotion restrictions, as well as richer lists, more effective logistics, and more thoughtful after-sales services. This was supplied by each e-commerce platform, attracting more consumers to participate in the online buying binge.

Let’s examine how e-commerce platforms, categorie, and brands fared at the 618 festival this year.

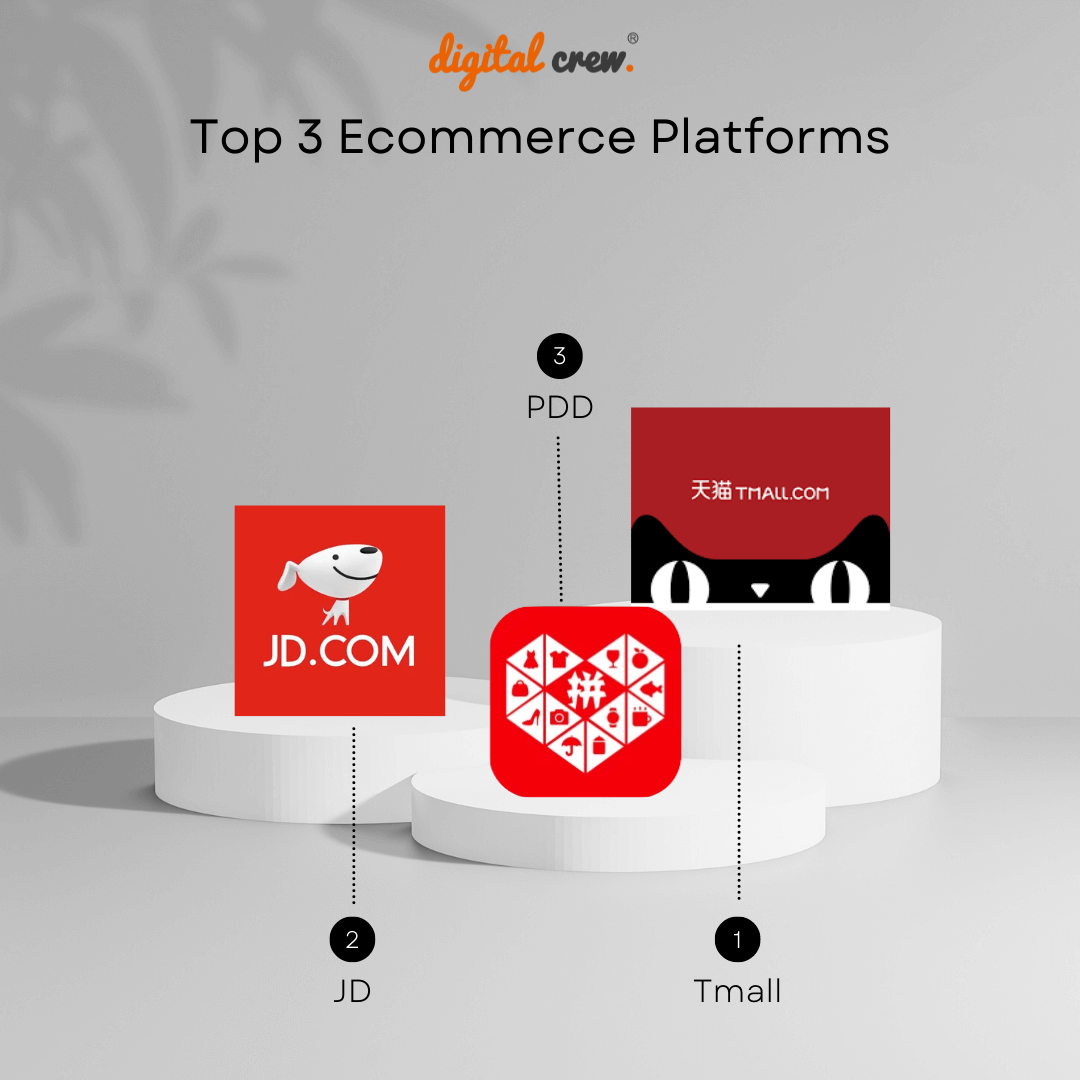

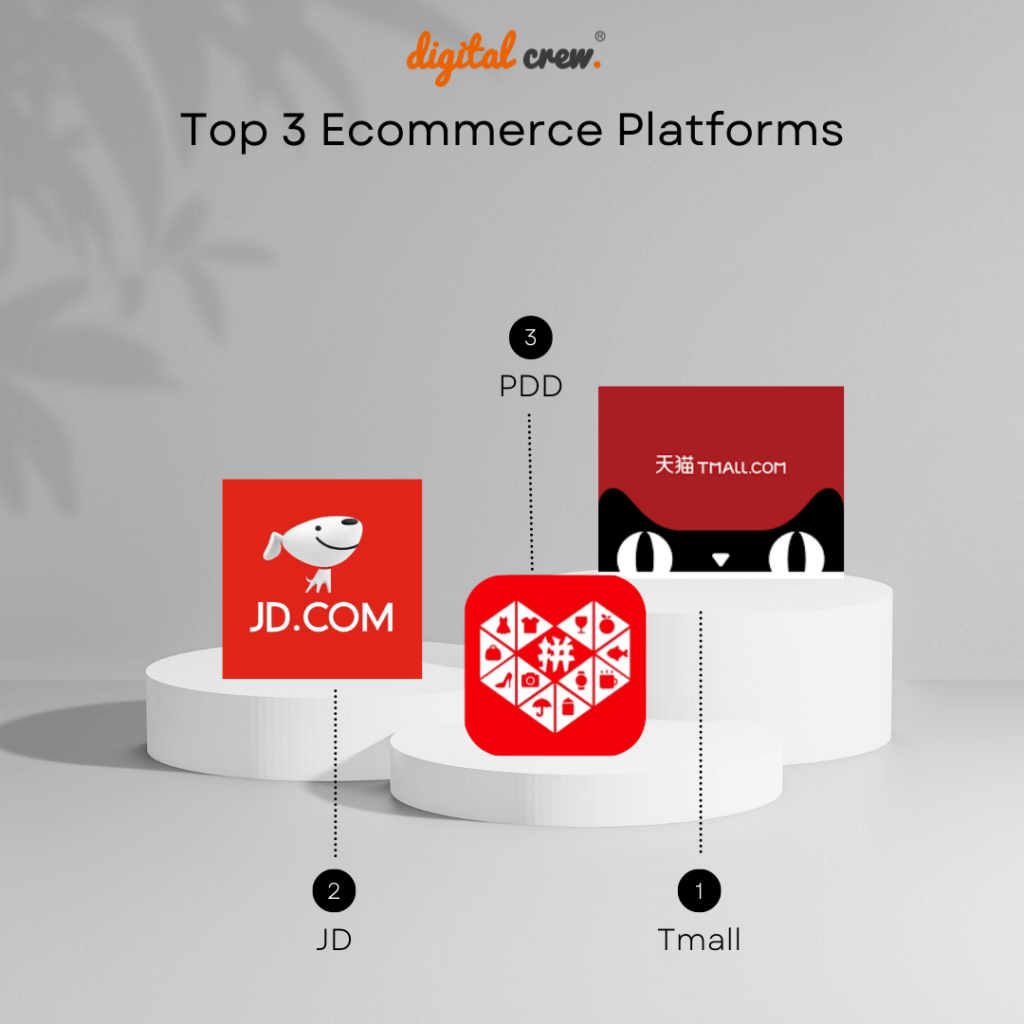

Top 3 Ecommerce Platforms

The top three platforms remained the same as in years prior, with TMall leading the way, followed by JD and PDD. Furthermore, the GMV of traditional e-commerce platforms this year reached 582.6 billion yuan.

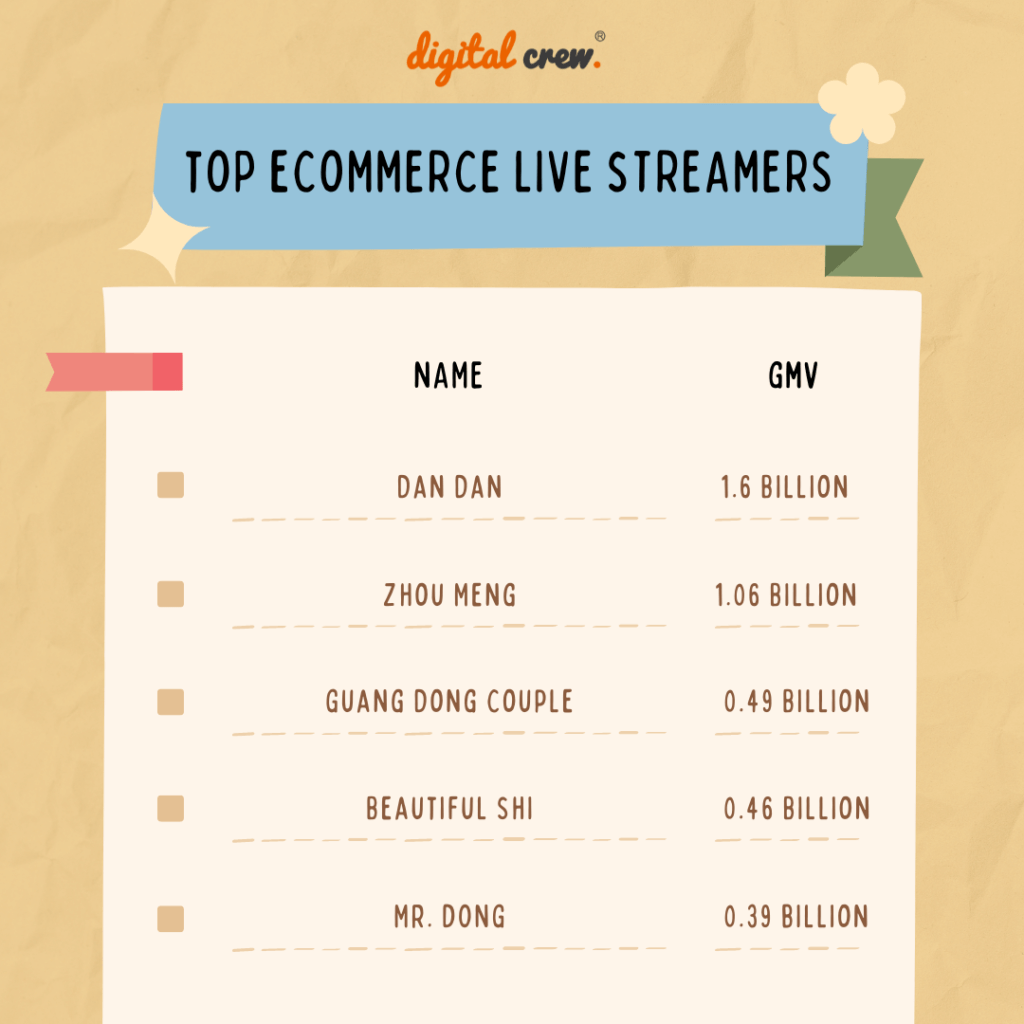

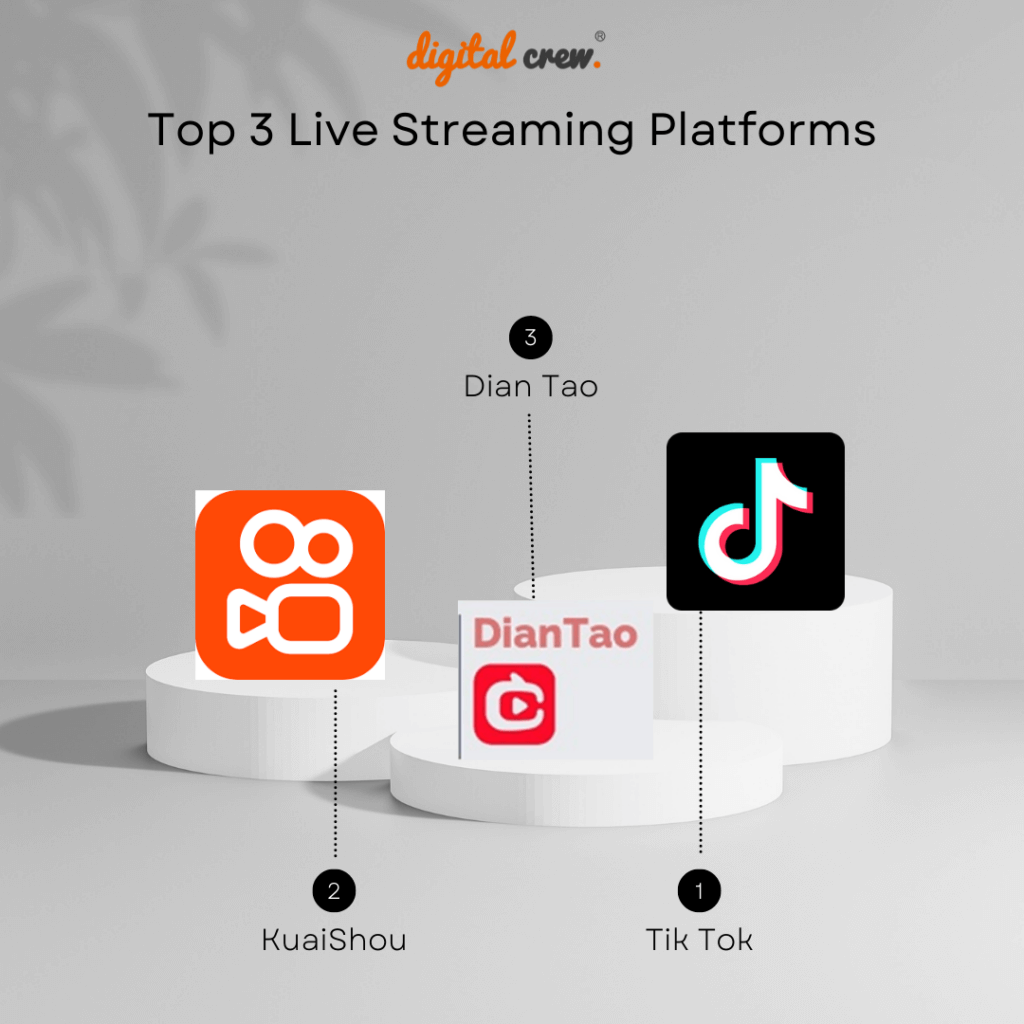

Top 3 Live streaming Ecommerce Platforms

Live streaming eCommerce platforms fared well, with a GMV of 144.5 billion yuan. The departure of Li Jiaqi and other DianTao Live Streamers changed the hierarchy of live streaming eCommerce platforms in 618, with DianTao dropping behind TikTok and KuaiShou to third place.

Alibaba

Taobao streamlined the preferred rules and marketing complexity in June, this year. For every 199 or 1000 yuan spent, the discount for cross-store sales was reduced by 20 yuan or 50 yuan.

There were six brands with revenues exceeding one billion yuan in a single category, among the 35 categories counted in a third-party research company Nint’s report.

A total of 108 brands had sales in excess of one billion yuan. Apple, Midea, Haier, Xiaomi, and L’Oreal were among the top five in overall sales. Apple is the only brand with more than 10 billion yuan (US$2.23 billion) in sales and has emerged as the clear victor.

JD.com

JD’s data suggested that the “post-95” generation’s spending power is increasing, with pre-order sales increasing by 75% year on year. Meanwhile, the product variety offered on JD.com during this year’s shopping festival climbed by 20%. The demand from China’s sixth-tier cities increased by more than 100% year on year.

Home appliance sales increased by 200 percent year on year, while order volume for new products tripled. Tablet, home printer, and mechanical keyboard sales climbed by 100, 170, and 400 percent, respectively.

JD Health’s overall order volume in the healthcare area increased by 186 percent year on year. In the first 10 minutes…

Several brands, including Xiaomi, Midea, Haier, Lenovo, Apple, HONOR, Huawei, SONY, Asus, Siemens, sold more than RMB 100 million yuan worth of products in the first 10 minutes of the 618 shopping festival. According to JD’s data, the most popular search keywords in the first 10 minutes were smartphones, air conditioners, Chinese sticky rice dumplings for the Dragon Boat Festival (which occurred on June 3 this year), infant formula, and toys. Over a hundred home brands on JD.com saw their sales jump in the first 10 minutes.

JD Worldwide provides Chinese customers with cross-border imports. In the first 10 minutes, nearly 150 international brands saw sales increase by more than 200%. Sales in roughly 100 subcategories increased by more than 100% year on year. Nintendo, Swarovski, and a2 milk powder are the top three selling brands.

JD.com recorded a total transaction volume of RMB 379.3 billion yuan (US$56.7 billion) for JD 618 Grand Promotion 2022 as of 23:59 on June 18th Beijing time; above the previous year’s RMB 343.8 billion yuan.

Tik Tok

Douyin e-commerce witnessed a total of 28.52 million hours of live streaming during 618 last year. From June 1 to June 18 2022, it reached 40.45 million hours, an increase of more than 40% over the same period the previous year.

115.1 billion short videos integrated with shopping carts were viewed. During the 618 event, the “search” option was really useful. Douyin mall saw a 514 % increase in sales year on year, and the number of engaged retailers climbed by 159 %.

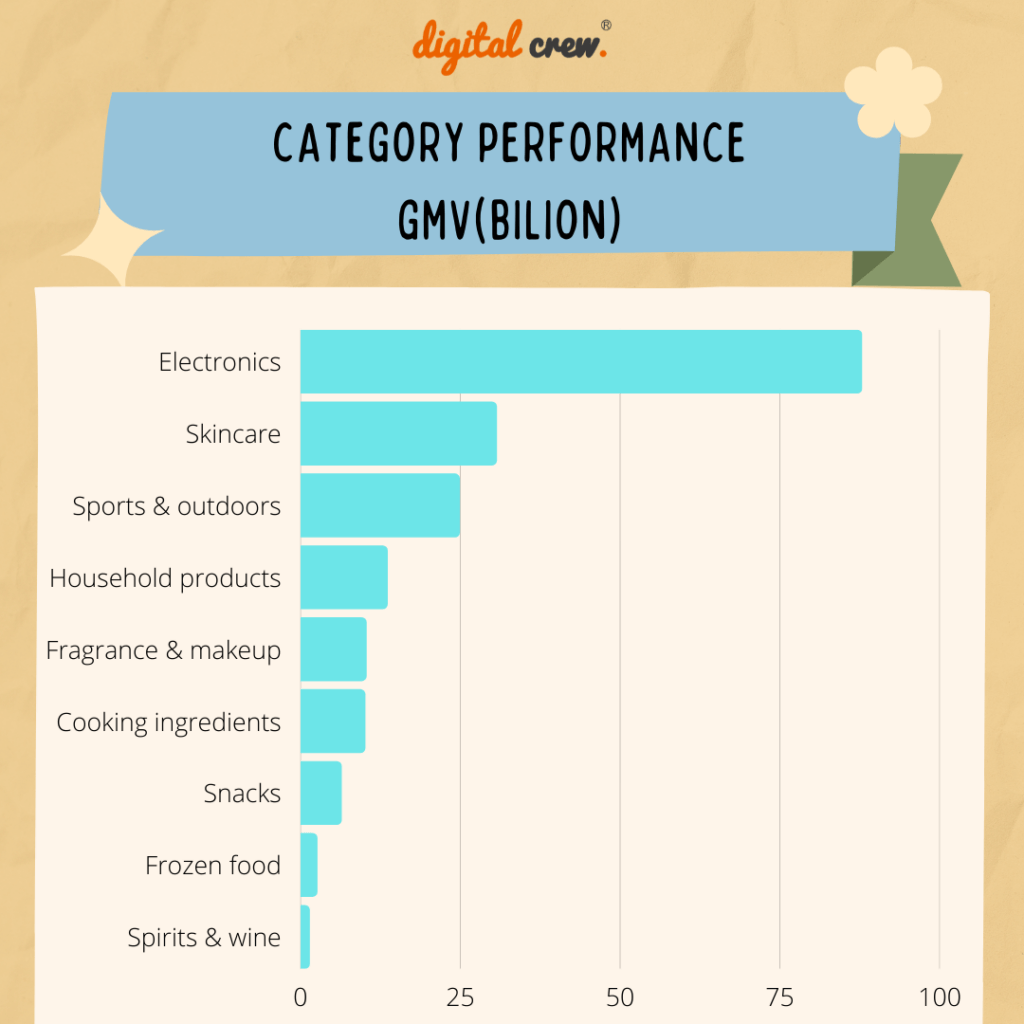

Sales Categories

In terms of overall sales categories, household appliances and electronics fared well and climbed at a 6.7 % year on year growth rate. While skincare, fragrance, and makeup declined 18.9 % and 22.1 %, respectively, year on year.

At the event, companies ranging from pasta producer Barilla to shampoo company Ryo offered “stock up” bundles featuring bulk orders of their products.

During 618, the GMV of Household Appliances/Electronics was 87.9 billion. Midea, Haier, and Gree were the top three most popular brands.

In Closing

618, which debuted in 2010, is China’s second-most important shopping event, trailing only Alibaba’s Single’s Day shopping event on November 11. Over the last decade, the event has evolved from a JD-created rival event to a vital mid-year shopping campaign for all e-commerce giants.

This year’s event shows us that Chinese consumers are back. With One-Stop Digital Marketing Solutions, Digital Crew enables international brands to thrive in the Chinese market, especially during these shopping holidays. Get in touch with us today.