China is poised to take over the United States and become the world’s largest retail market. In this market, one area is particularly promising: cross-border e-commerce transactions. Statistics suggest that China’s cross-border e-commerce market size will reach $12.7 trillion RMB (US$1.81 trillion) in 2020. According to the China Chamber of International Commerce, the number of consumers in China who purchase goods from online e-commerce platforms had increased by ten times between 2015 and 2018.

Defined as import and export activities of cross-border trade via e-commerce platforms, cross-border e-commerce has become part of Chinese consumers’ routines. Who are in this group of consumers? What are they looking for when they make purchases via cross-border e-commerce platforms? Which platforms are the major players in this market?

Portraits of cross-border e-commerce consumers

If you are looking to reach out to China’s younger generation, cross-border e-commerce is a market that you cannot miss. According to recent consumer reports, the post-90 and post-95 (i.e., individuals born about 1990 and 1995 respectively) have taken over the post-80 (i.e., those born between 1980 and 1989) and become the largest consumer group of the cross-border e-commerce platforms in China since 2017.

The demands for higher-quality, safer and cheaper products (i.e., less duties) grow at the same time as the purchasing power of the Chinese consumers. The two most popular foreign goods among these consumers are cosmetics and products for babies and mothers. In the meantime, the types of overseas goods Chinese consumers are interested in are also diversifying. Besides skin and personal care products, which took up 32% of the total cross-border e-commerce transaction volume, pet products, electronics, and overseas fashion brands have all seen an increase in recent transaction volumes.

Here are four cross-border e-commerce platforms that are popular with Chinese consumers.

Alibaba’s Tmall and Tmall Global

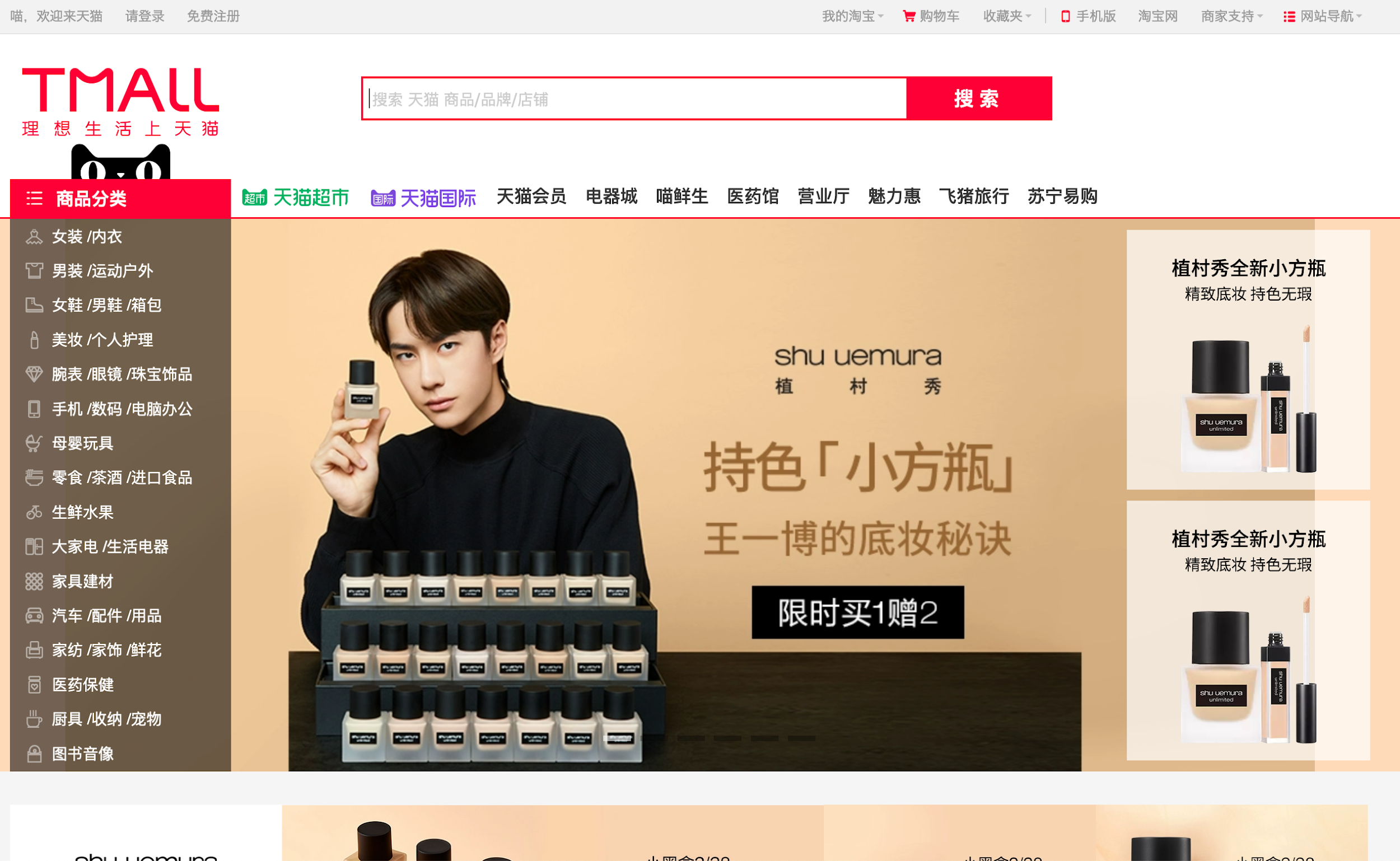

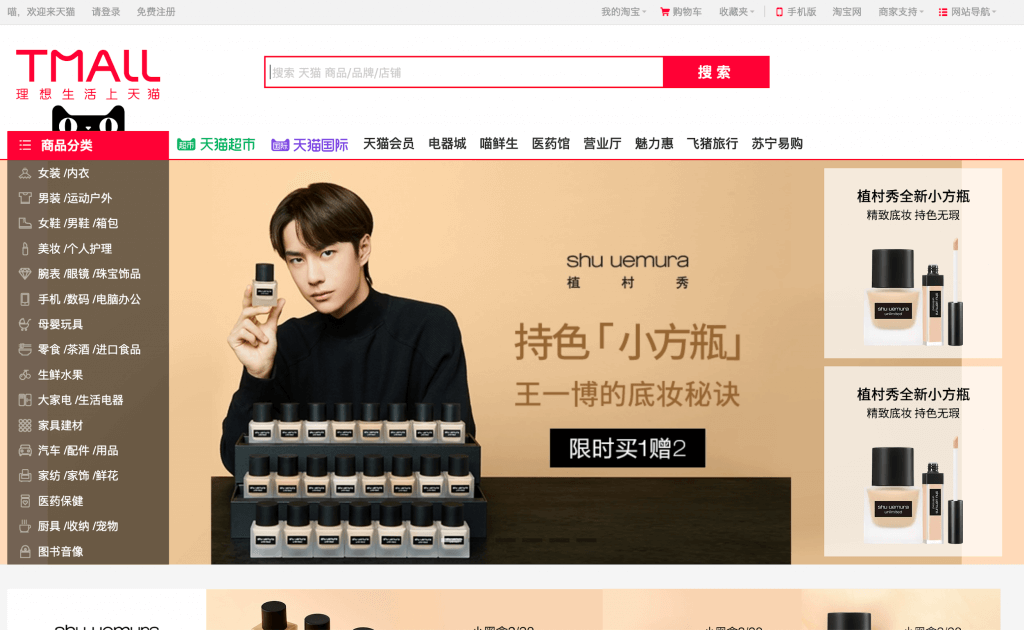

Tmall, formerly Taobao Mall, is a business-to-consumer online retail platform operated by the Chinese Internet giant Alibaba Group. It spun off from Taobao in 2008 to allow local Chinese and international brands to sell goods to Chinese consumers. As the longest established online retailer, Tmall is the first go-to place for many to purchase overseas goods.

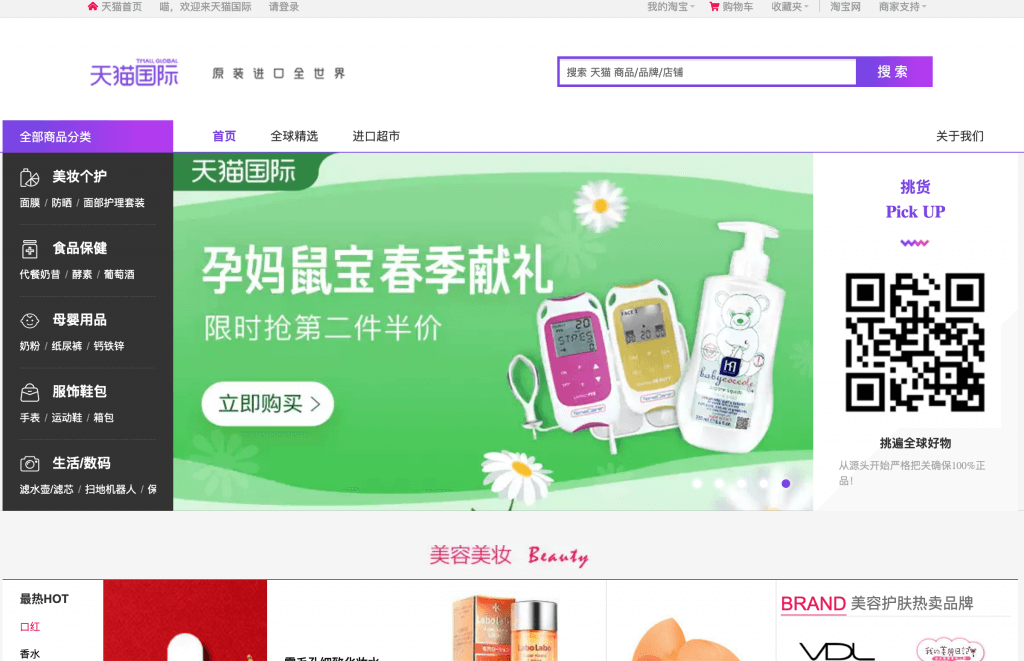

One thing businesses and marketers should take note of is that Tmall has two extensions: the domestic version (tmall.com) which is for brands that have a business entity located in mainland China holding a Chinese retail business license, and the international version called Tmall Global which is a marketplace designated for cross-border e-commerce allowing foreign brands without a mainland Chinese operation to reach Chinese consumers.

Tmall prides itself on carrying high-quality brand name products. This is one of the reasons why the rejection rate of setting up a store on Tmall.com is high. Tmall Global has a relatively more relaxed restriction and it is considered a way for smaller brands to try out the Chinese market before they commit to any on-the-ground operations. To operate a store on Tmall Global, brands can choose from three major store types: flagship store, authorized store, or specialty store. Over 20,000 brands in over 4,000 categories from 77 countries and regions have chosen to open a store on Tmall Global as of March 2019.

Though not the first to create social e-commerce experiences for consumers, Tmall has been paying close attention to the increasingly influential Generation Z consumers. Thanks to the Alibaba ecosystem such as Taobao Livestream, brands have access to a wide range of marketing tools on Tmall and Tmall Global to appeal to different audiences.

NetEase Kaola/ Kaola Haigou

Launched in 2015, Kaola is one of the most important players in China’s cross-border e-commerce platforms. Developed by Nasdaq-listed NetEase, Kaola was acquired by Alibaba in a deal worth US$2 billion in late 2019. As part of the acquisition, NetEase Kaola changed its name to Kaola Haigou.

Although it is now co-operated by Alibaba, Kaola differentiates itself from Alibaba’s Tmall in many aspects. Whereas Tmall focuses on well-established international brands and serves as an official public-facing online store for these brands, Kaola provides easier access for a wider range of ordinary brands. It is estimated that Kaola carries with over 5,000 brands from 80 countries covering apparel, maternity and infant care, household appliances, personal care, health care and other major categories of products. The platform is also actively expanding fashion and sports products.

Another area Kaola excels at is its pricing. Thanks to its warehouses in free-trade zones, Kaola is able to offer quality products at a cheaper price than if a consumer were to buy them at overseas physical stores. It also frequently offers daily deals, membership deals, and coupons as an effort to attract and retain consumers.

Besides these features, Kaola stands out from its competitors by being one of the first to develop a social feature on its platform. Zhongcao Shequ, which literally means “grass-growing community” (a Chinese buzzword for having a desire for a product because someone else recommends it), is a feature consumers can access via Kaola’s mobile application. It is an online community allows consumers to reviews or ask for advice about products they use or are interested in. The topics of community posts range from skincare, fitness, baby products, and fashion. The video- and image-heavy format enables consumers to have a straightforward and visual understanding of different products. Additionally, readers of a post can easily purchase the products mentioned in a post within a few clicks, providing users a seamless online purchase experience.

JD Worldwide

As one of the largest e-commerce platforms in China, JD.com (which stands for Jingdong) has expanded its business outreach in 2015 by launching JD Worldwide. It was Jingdong’s initiative to enter China’s booming cross-border e-commerce business.

JD Worldwide functions like an online shopping mall where brands, franchisees, and third-party retailers can open up and operate storefronts. Similar to Tmall Global, JD Worldwide provides an opportunity for international brands that wish to tap into the Chinese market without committing to a physical store in China.

To facilitate international merchandise’s operations and improve Chinese consumers’ experience, JD Worldwide provides global shipping and warehousing solutions that ensure overseas products to be delivered timely and securely to the doorsteps of China-based consumers.

Xiaohongshu

A new and rising contender in China’s cross-border e-commerce scene is Xiaohongshu. Established in 2013, Xiaohongshu is a social e-commerce app with over 250 million registered users as of 2019. In 2014, Xiaohongshu launched its own “RED store” in response to the growing demand of China’s sophisticated buyers and social media users’ to shop for quality foreign goods.

Xiaohongshu users can purchase global brand name products directly on Red Store through the app. As of now, Xiaohongshu has secured partnerships with international brands including Innisfree, Lancôme, NuFace, L’Oréal and more.

Compared to Tmall, Kaola, and Jingdong, Xiaohongshu and its users focus heavily on beauty, fashion, and lifestyle. Additionally, its social element defines the identity of Xiaohongshu and partly explains why it can stand out from other larger e-commerce platforms. The app acts as a platform for consumers to share their shopping experience, life hacks, produce reviews, and even personal stories. The social feature and its focus on authentic content generation help develop the platform into a trusted source of product recommendations and a shopping destination for many female consumers in China.

China’s cross-order e-commerce market is projected to continue growing. To find out more about how to make the best use of each platform and how they could benefit your business, reach out to our specialists today for a more in-dept guide.