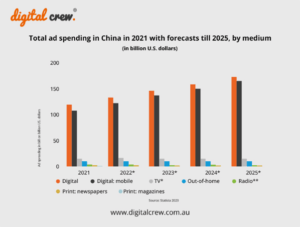

As more and more people in China use the internet as part of their daily lives, advertisers are increasing the amount they spend on digital ads. At the same time, spending on television and print media is falling.

Media company GroupM says that at least 57% of ad spend in 2017 will be digital. This is almost double the rate of digital ad spend globally.

In addition, mobile is expected to account for more than 80% of the digital ad spend by 2021, according to eMarketer.

A snapshot of digital ad trends in China

Here are some of the digital advertising trends in China:

- Digital ad spend in China is expected to reach USD $84.4 billion during 2017.

- TV spending is expected to fall by about 5% this year, although television does remain a highly influential form of media. An exception is China Central TV (CCTV), the country’s national broadcaster, which is tipped to increase spending by 5%.

- Content marketing is growing at the rate of approximately 20% year-on-year.

- Out-of-Home (OOH) advertising (outdoor advertising such as billboards and digital signage) is also growing.

- Print media ad spending is declining at a fast rate, with a drop of about 54% expected this year for newspapers and almost 40% for magazines.

- Spending on radio is also reducing by around 8%. At the same time however, radio is considered to have relatively good reach due to growth in car ownership and the popularity of mobile radio apps.

- By 2020, mobile video is expected to account for 73% of digital video ad spending.

- By 2021, 82% of all digital advertising is expected to be mobile-dedicated.

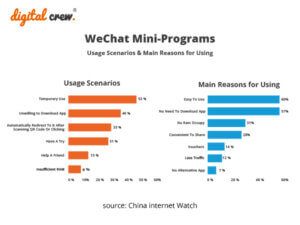

- Tencent is continuing to monetise WeChat through various advertising formats.

- While Baidu dominates in terms of online ads, it has been impacted by new government regulations and stricter standards around online search advertising, such as more clearly identified ads and seeking permissions from users.

Despite the huge growth in digital advertising, it is expected to level off as the internet market approaches saturation point. This is due to the fact that almost everyone in urban areas now uses the internet and there are less new users coming on the scene.

Influencing factors on advertising

Naturally, the shift towards internet use in advertising is hugely influential. There are however other factors at play when it comes to advertising, such as:

- Higher mobile use – GroupM states that 95% China’s netizens went online through mobile devices during 2016.

- Big data – this has played a crucial role in the development of new types of OOH advertising during 2016.

- Increased urbanisation – this has influenced not only internet use but also China’s subway line expansion, which has led to more use of OOH advertising.

- Locations – interactive channels are utilised more in Tier 1 and 2 cities, while static billboards are used in Tier 3 and 4.

- Major events – for example CCTV received a boost in 2016 from major sporting events such as the summer Olympics and the Euro soccer tournament.

Putting it all together

Making sense of all the data should enable marketers to make better-informed decisions when it comes to their China digital spend.

Here are a few tips:

- A multi-channel approach – utilising a mix of digital channels rather than just one or two is recommended, as this may provide cross-channel opportunities.

- Social media – social remains very influential for consumers in China, especially WeChat, and companies should consider including social media channels in their advertising mix.

It’s also important to keep an eye on the horizon as nothing in this sphere remains static. Feel free to contact our bilingual team for help in negotiating the digital ad market in China or any other aspect of digital marketing in China.