Ophenia Liang shared Digital Crew’s insights about Consumer Finance in China

Mumbrella’s Finance Marketing Summit returned for its third year with nearly 350 marketers gathering for a one day download of the latest ideas, leading strategies and most important issues for marketers in and around the financial services industry on 25th July 2018. The summit put a spotlight on new brands breaking into a heavily regulated space, established players pivoting to meet the new consumer, multicultural financial marketing, the impact of open banking, customer experience opportunities and nervous consumers facing interest rate rises, providing finance marketers with answers for the year ahead.

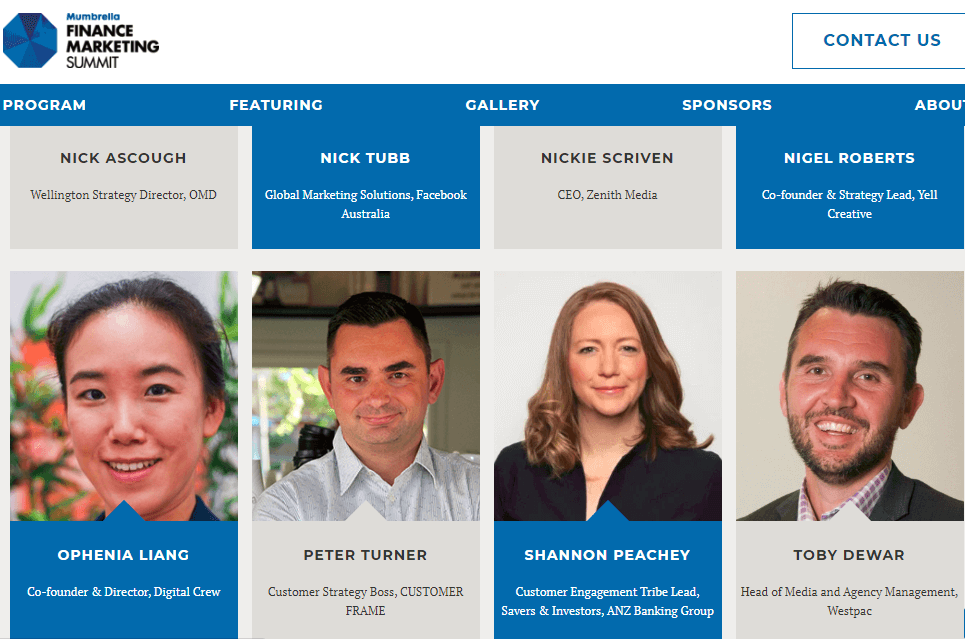

- The Finance Marketing Summit line-up served up expert insights into Australia’s financial services industry. Ophenia Liang from Digital Crew drew her observations from the financial landscape In China at the Summit with ‘Chinese Money’ being the focal point of discussion.

- As a multilingual digital agency that helps businesses market to different countries and cultural segments, Digital Crew bridges the cultural gaps for their clients and digs deep into the financial mindsets of individuals in China.

Foreign Financial Investment Sector

- She placed clear emphasis on China’s CAGR in the retail market that rose from $5.17 trillion to $6.21 trillion in 2018 and its projection to increase to $8.05 trillion by 2021. She brought the foreign financial investment sector into the limelight as China is on the verge of welcoming foreign investors into the car and consumer finance market along with lifting foreign ownership restrictions on banks and financial management companies by the end of the year.

- “The Consumer finance market size reached ¥31.5 trillion (= $6.3 trillion AUD) out of which 223 million users were funded via mobile. Credit card penetration remains high, but the growth rate of micro-loans is scaling up faster than personal loans owing to immediate satisfaction of status demands by the millennials. Finance companies like Ant Credit Pay & China Migrants Bank have successfully managed to target this segment through dating and trendy video apps” according to her report.

Conclusion

The seminar enlightened the audience about the billion-dollar market in China and a projection of the future in terms of policies and trade relations with the rest of the world. A strong focus was drawn towards the consumer finance market that harbours commercial banks like Bank Of China, industry giants like Baidu, credit unions like Suning, P2P and other non-bank lenders with Chinese millennials at the forefront of this market consumption.